Financial independence: it’s a term used often in the financial industry. It’s used daily here at…Financial Independence Group. But when we’re talking about your clients’ financial independence, we’re talking about a sound, safe, and comfortable retirement. One that means they no longer depend on outside sources of income to live. Everything is peachy. Everything is fine. It’s what most people dream of in retirement.

But many Americans won’t ever achieve it. They’ll be left to worry how they’ll fare in retirement—especially those close to it.

Hopefully, none are your clients.

Help them better prepare for the future by nudging them in the proper direction. Feel free to share these ten tips for achieving financial independence the next time you sit down with your clients.

Financial Independence Tips

1. Create action plans that’ll get your clients where they want to be.

Achieving financial independence isn’t about one big plan coming to life. It’s about completing a whole series of small plans on time. Finding your clients’ financial freedom will require time and research on your part to establish and achieve the goals you’ve set out.

Give your clients a list of these various goals so they’re officially established. You’ll be able to track your progress easier, too.

2. Save money, even if it’s just a little.

It’s always a good idea to save money, no matter what’s happening. Even if it’s not much, saving money creates healthy habits and ensures they’re always making progress towards the overall goal: financial independence.

Related: What Annuities Are and How They Can Help Your Savings Last [Client Guide]

3. Early on, help them develop an ICE egg.

It’s not a nest egg. It’s an in-case-of-emergency (ICE) egg.

Nearly 80% of Americans workers live paycheck to paycheck. That’s a little alarming. One of the first financial goals anyone should have is to set up an emergency fund in case an unplanned event happens. It’s a good idea to suggest the ICE egg cover between three and six months of living expenses.

4. The tax-advantageous route is a great way to go.

Heavy taxes can reduce a client’s income, meaning it’s harder to save and pay off debts. When you’re planning, try to think about the tax-saving strategies that could result in less money for Uncle Sam—and more money for their retirement.

Related: Tax Breaks for Charitable Giving Have Disappeared – How Can You Help?

5. Being insured means being smart.

I’m sure you’ve heard it before. The “It won’t happen to me.” It’s a line that financial professionals know a little too well.

It’s important to talk about the what-ifs of life, and how you can help your clients be protected. As clients age and their wealth grows, their insurance coverage should increase as well. That way, all their assets are protected in case of the unthinkable.

6. Encourage them to spend responsibly.

Ask about spending habits. If there seems to be concern about how much money is being spent, let them know. Clients who tend to have more fun with their expenditures instead of putting money away can always get hurt in the long run.

7. Refocus goals annually.

Helping your clients create—and stick to—their financial goals are vitally important to their financial independence. The action plans noted in the first tip can help you and your clients stick to a method for financial success.

But with everything in life, things change. Take the time to review financial goals with your clients each year to make sure everything is going smoothly. It can be easy to get pulled in different directions financially, so sit down each year with your clients to renew their commitments.

Related: Client Relationship-Building: A Sales Skill for Advisors

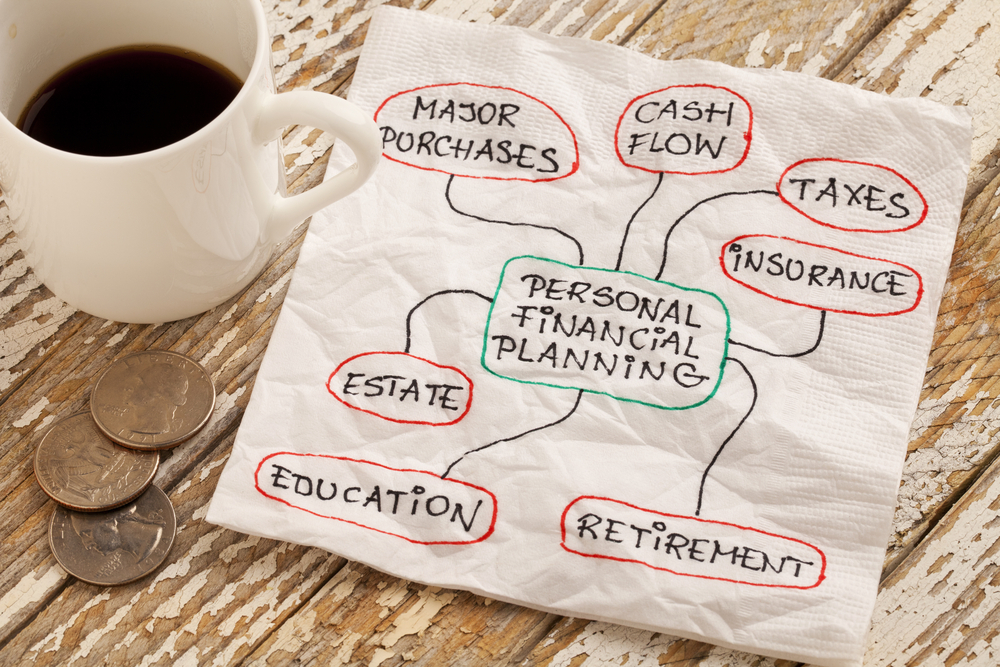

8. Keep learning about personal finance.

You’re the financial expert for your clients. They rely on you to guide them through life’s financial obstacles. But that doesn’t mean they shouldn’t understand (and even appreciate) personal finance.

However, you can encourage your clients to continuously learn about personal finance. That can mean sharing relevant articles or videos with them, recommending books, or maybe even creating content yourself. Every bit of personal finance knowledge will help them think more strategically about their money. And strategically thinking can equate to financial independence.

9. Avoid consumer debt.

Consumer debt can be a financial independence killer—especially credit cards with the ridiculous annual percentage rates. That alone can make your clients feel like they’re playing credit card catch-up for decades.

Did you know that the collective debt for Americans is over $4 trillion? And yes, you did read that correctly.

Try to focus your clients’ thoughts on healthy spending habits rather than the latest and greatest trends. If they can focus in on their livelihood and financial well-being, they may begin ignoring those more lavish impulses.

10. Explain the marshmallow test.

The marshmallow test was an iconic series of psychological studies from the 1960s that examined the power of delayed gratification to motivate preschoolers to stay under control—and it’s an oddly compelling way to explain what it may take to achieve financial independence.

The test placed a marshmallow in front of children, and if they waited 15 minutes to eat it, they would be rewarded with two additional marshmallows to snack on. However, many children couldn’t wait. The results found that decades later, the children who did wait were more successful individuals overall. It’s a great lesson in self-control, and at the very least, it could show your clients that if some 4-year-olds can practice delayed gratification…they can in their finances, too.

Read more: 4 Ways to Evaluate Retirement Preparedness [Infographic]

Bottom Line

As a financial professional, you play a prominent and vital role in your clients’ journey to financial independence. And while no single piece of advice or strategy can achieve financial independence alone, these quick tips can serve as valuable conversation starters the next time you sit down with your clients to plan for their future.

For Internal and Financial Professional Use Only – Not for Customer Use