Updated April 10, 2024 at 3:45 PM

Care planning solutions are often overlooked by financial professionals for several reasons, the most common being the intimidation felt by a space they’ve never dealt with before and the emotional response this subject produces.

Ironically, financial professionals have the most to gain by incorporating this line of business over others that clients want and use. So why should you as a financial professional talk about care planning?

You should talk about it because it’s making a massive resurgence in the insurance and retirement planning industry. Care planning is no longer a “maybe discussion,” these are mandates for tomorrow’s financial professional. Many of your clients believe they have enough money to self-fund an extended care event, but if they begin using more than they planned, it’ll have a severe impact on their financial plan, thereby impacting you as well.

The Need for Care Planning

According to the National Clearinghouse for Long-Term Care Information, around 70% of individuals over age 65 will require some type of long-term care (LTC) service during their lifetime. Of Americans age 65 and older today, one in five will require LTC services for five or more years.

The number of Americans living with Alzheimer’s disease is growing, too. An estimated 5.4 million Americans of all ages have Alzheimer’s’ disease and these numbers are increasing at an alarming rate. By 2050, the number of people over the age of 65 with Alzheimer’s or dementia may nearly triple. Let that sink in…

Given these facts, the question now becomes not whether an extended care event will affect your client’s retirement income plan, but when? When a person’s income needs drastically increase, where will the money that pays for the care come from? They may need to liquidate investments in managed accounts, annuities, and cash equivalents.

If your business model creates plans to generate income during retirement, paying for care will disrupt every aspect of your model. What will happen to it when at least 20% of your clients over age 65 are pulling between $50,000 and $120,000 out of their portfolios annually for more than five years? We know the costs of care are increasing, but they’re expected to dramatically jump as baby boomers are aging into this phase of life.

Related: 6 Ways to Improve Your Closing Rates For Long-Term Care Insurance

The Importance of the Care Planning Conversation

Can you ensure your clients attain a rate of return high enough to get an additional $70,000 a year or more to fund care events that could last 5, 10, or even 15 years or longer? Paying for care requires re-allocation of income streams and can have a direct impact on your clients’ ability to keep financial commitments they may have. It’s a discussion you need to have with every single client.

Historically, financial professionals have felt that having the care planning conversation meant initiating emotionally-charged and tense discussions since it’s not a topic many enjoy thinking about—the inevitable aging process and potential loss of independence. Care planning is overlooked as a product line to offer because financial professionals don’t know how and why they should talk about it.

I think what scares agents most is, they don’t know what they don’t know.

Over the years, the landscape has changed in the LTC industry. When I started in this industry more than 20 years ago, most care planning solutions involved using traditional LTC (LTC) insurance. It’s always been the cheapest way to secure the largest pool of LTC benefits to start but it can come with a bad reputation (thanks, rate changes).

We’ve seen many carriers raise rates anywhere from 5-150% range. Additionally, many of the major insurers have left the marketplace because lower lapse rates have paired with higher claim experiences, and it’s been devastating. The critical detail to note here is this: LTC events are an inevitable milestone for most of our aging population and they require planning.

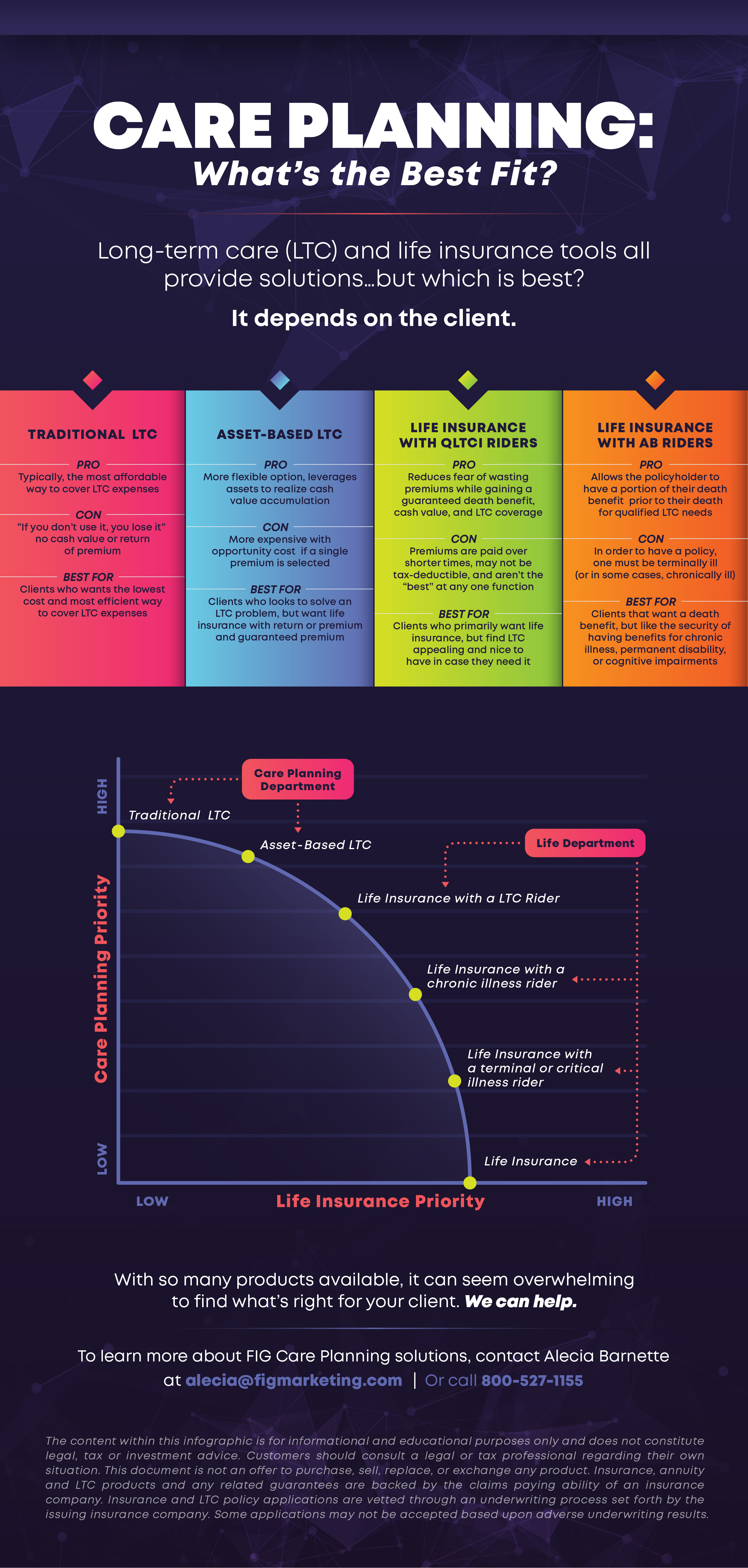

Do I think traditional LTC insurance is still a good fit? Absolutely! However, I do believe there are many different solutions available that are becoming more popular. Check out our infographic outlining the different solutions available to you in the marketplace.

Related: How to Be a Health Care Advocate [Client Infographic]

Your Care Planning Resource

What do numerous solutions mean for you as a financial professional? It means you have options.

Many of the objections that you’re facing in the industry can now be overcome. Let’s take, for example, rate increases. Here at Financial Independence Group, we focus primarily on asset-based LTC as a solution. With this class of products, you have guarantees. Your client won’t experience rate increases and they’ll have a benefit whether they live, die, or walk away from the policy.

We believe care planning isn’t a one-size-fits-all approach because every client is different. Remember, if your client doesn’t have a plan, then their money is their plan by default. You don’t have to be an expert in this space because that’s what we’re here for. You only need to be brave enough to start the care planning conversation with your clients to uphold your fiduciary responsibility.

We can teach you how to approach this in an easy, repeatable, and product-agnostic way because of the many solutions available.

Keep Reading: Care Planning: A Personal Perspective

The content within this infographic is for informational and educational purposes only and does not constitute legal, tax or investment advice. Customers should consult a legal or tax professional regarding their own situation. This document is not an offer to purchase, sell, replace, or exchange any product. Insurance, annuity and LTC products, and any related guarantees are backed by the claims-paying ability of an insurance company. Insurance and LTC policy applications are vetted through an underwriting process set forth by the issuing insurance company. Some applications may not be accepted based upon adverse underwriting results.